Month: January 2012

I believe that science fiction is reality catching up to the future. Others say that science fact is the science fiction of the past. Regardless, the gap between science fact and science fiction is fascinating to me, especially as it applies to computers.

I believe that science fiction is reality catching up to the future. Others say that science fact is the science fiction of the past. Regardless, the gap between science fact and science fiction is fascinating to me, especially as it applies to computers.

My partners and I spend time at CES each year along with a bunch of the founders from different companies we’ve invested in due to our human computer interaction theme. In addition to a great way to start the year together, it gives us a chance to observe how the broad technology industry, especially on the consumer electronics side, is trying to catch up to the future.

We are investors in Oblong, a company who’s co-founder (John Underkoffler) envisions much of the future we are currently experiencing when he created the science and tech behind the movie Minority Report. Oblong’s CEO, Kwin Kramer, wandered the floor of CES with this lens on and had some great observations which he shares with you below.

Looking back at last year’s CES through the greasy lens of this year’s visit to Vegas, three trends have accelerated: tablets, television apps platforms, and new kinds of input.

I gloss these as “Apple’s influence continuing to broaden”, “a shift from devices to ecosystems,” and “the death of the remote control.”

Really, the first two trends have merged together. The iPod, iPhone, and iPad, along with iTunes, AirPlay, and FaceTime, have profoundly influenced our collective expectations.

All of the television manufacturers are now showing “smart” TV prototypes. “Smart” means some combination of apps, content purchases, video streaming, video conferencing, web browsing, new remote controls, control from phones and tablets, moving content around between devices, screen sharing between devices, home “cloud”, face recognition, voice control, and gestural input.

Samsung showed the most complete bundle of “smart” features at the show this year and is planning to ship a new flagship television line that boasts both voice and gesture recognition.

This is good stuff. The overall interaction experience may or may not be ready for the mythical “average user”, but the features work. (An analogy: talking and waving at these TVs feels like using a first-generation PalmPilot, not a first-generation iPhone. But the PalmPilot was a hugely successful and category changing product.)

The Samsung TVs use a two-dimensional camera, not a depth sensor. As a result, gestural navigation is built entirely around hand motion in X and Y and open-hand/grab transitions. The tracking volume is roughly the 30 degree field of view of the camera between eight feet and fifteen feet from the display.

Stepping back and filtering out the general CES clamor, what we’re seeing is the continuing, but still slow, coming to pass of the technology premises on which we founded Oblong: pixels available in more and more form factors, always-on network connections to a profusion of computing devices, and sensors that make it possible to build radically better input modalities.

Interestingly, there are actually fewer gestural input demos on display at CES this year than there were last year. Toshiba, Panasonic and Sony, for example, weren’t showing gesture control of TVs. But it’s safe to assume that all of these companies continue to do R&D into gestural input in particular, and new user experiences in general.

PrimeSense has made good progress, too. They’ve taken an open-hand/grab approach that’s broadly similar to Samsung’s, but with good use of the Z dimension in addition. The selection transitions, along with push, pull and inertial side-scroll, feel solid.

Besides the television, the other interesting locus of new UI design at CES is the car dashboard. Mercedes showed off a new in-car interface driven partly by free-space gestures. And Ford, Kia, Cadillac, Mercedes and Audi all have really nice products and prototypes and employ passionate HMI people.

For those of us who pay a lot of attention to sensors, the automotive market is always interesting. Historically, adoption in cars has been one important way that new hardware gets to mass-market economies of scale.

The general consumer imaging market continues to amaze me, though. Year-over-year progress in resolution, frame rate, dynamic range and cost continues unabated.

JVC is showing a 4k video camera that will retail for $5,000. And the new cameras (and lenses) from Nikon and Canon are stunning. There’s no such thing anymore as “professional” equipment in music production, photography or film. You can charge all the gear you need for recording an album, or making a feature-length film, on a credit card.

Similarly, the energy around the MakerBot booth was incredibly fun to see. Fab and prototyping capabilities are clearly on the same downward-sloping, creativity-enabling, curve as cameras and studio gear. I want a replicator!

And, of course, I should say that Oblong is hiring. We think the evolution of the multi-device, multi-screen, multi-user future is amazingly interesting. We’re helping to invent that future and we’re always looking for hackers, program managers, and experienced engineering leads.

It’s Monday and I’m back in Boulder after being on the east coast for three weeks. My partner Jason Mendelson got me possibly the best remote control toy ever.

Even though I’d love to stick around Boulder all week, I’m heading to DC tomorrow and then NY for a day. Oh well.

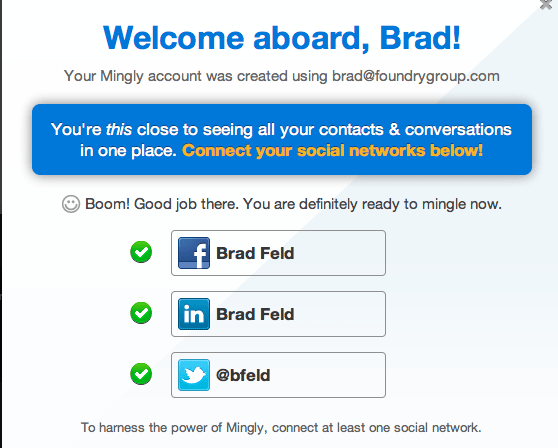

I noticed something when I tried out two apps (Mingly and Cobook) this morning – they each immediately asked to connect me to Facebook, LinkedIn, and Twitter during their onboarding process. And, by using my Gmail as the starting point / authentication, they connected me to G+.

Microsoft is conspicuously absent from this. I’ve noticed this many times in the past but when you onboard yourself in two contact-related apps in the same morning and there is no Microsoft anywhere, there’s something going on that’s important. I wonder if this will change with Office 365 – I hope Microsoft is building a trivial to use oauth to O365 so it’s easy to connect to, along with a good sync API.

I was trying to think of other authentication that would be helpful to me in the context of my contacts. Almost everything else I use is based on either my email address or auth with one of these four services. Hmmm.

So far Mingly feels basically the same as Gist but Cobook seems different than anything I’ve used. I have no idea if I’ll keep using either of these, but like many things in the themes we invest in, I love to play around with new apps for a while and see if it sticks.

After a long really fun day yesterday at TechStars and StartLabs I wandered over to 34-101 to be on a panel for Joost Bonsen and Joe Hadzima‘s IAP class 15.S21: The Nuts and Bolts of Business Plans. It’s not really a class about business plans rather a class about starting a business and has been regularly modernized by Joost and Joe. On the panel were the two founders of Super Mechanical (creators of Twine) which is an awesome project that used Kickstarter for its initial financing (and that I’m an excited supporter / customer of.) I had a fun day and wish I had found more IAP courses to help teach and participate in this trip.

After a long really fun day yesterday at TechStars and StartLabs I wandered over to 34-101 to be on a panel for Joost Bonsen and Joe Hadzima‘s IAP class 15.S21: The Nuts and Bolts of Business Plans. It’s not really a class about business plans rather a class about starting a business and has been regularly modernized by Joost and Joe. On the panel were the two founders of Super Mechanical (creators of Twine) which is an awesome project that used Kickstarter for its initial financing (and that I’m an excited supporter / customer of.) I had a fun day and wish I had found more IAP courses to help teach and participate in this trip.

After the course finished at 9:30, Joost and I wandered over to the Muddy Charles for a beer. When I crawled into bed at 12:30 my head was full of a ton of awesome ideas that came out of our rambling three hour discussion. I’ve been friends with Joost since the early 1990’s when we first met around the MIT 10K competition and have been a huge fan of his ever since.

Among other things we talked about the startup ecosystem in and around MIT and the evolution of Boston as a region. The comments in my post from yesterday titled I’m in Cambridge, Not Boston were great and stimulated additional thinking on this topic, as did Joost’s experience here over the past 20 years. Joost has incredible knowledge and history of the region and of MIT, which occasionally appears in posts like How Kendall Square Became Hip: MIT Pioneered University-Linked Business Parks but is really apparent when you spend extended time with him talking about MIT, how it evolved, what it is today, who has been involved along the way, and the entrepreneurial community that has evolved around it.

About mid-way through the conversation Joost dropped two phrases on me that blew my mind. The first was “Creative Construction.” As we were talking about startup communities and the new book I’m working on, Joost said “How about a play on words on Schumpeter’s “creative destruction” and call your theory about startup communities “creative construction” instead. After I put the exploded pieces of my brain back together and said “that is exactly fucking right” he went on. “Think of entrepreneurship as a tool of mass construction.”

The play on words is just delicious. And right on – we are talking about an awesome positive force in the world and should be using language that represents that. At the core of our conversation was the notion that an entrepreneurial region like Boston is actually a collection of 100,000 person “entrepreneurial neighborhoods” (that’s what Kendall Square is, as distinct from the Fort Point Channel area, or the Leather District, or what’s going on in Davis Square, or …). And the idea that creative construction drives this – and the neighborhoods are part of a broader entrepreneurial community (in the region) is a construct that resonates with me.

I’m off to HubSpot to give a talk, a swing through Venture Cafe at CIC, and then back to StartLabs for the rest of the day. My three weeks in Boston (well – Cambridge) with a side trip to New York is coming to an end. It’s been amazing, enlightening, educational, productive, and a lot of fun.

Over the last three weeks I’ve had numerous people ask me how my trip to Boston has been going. For a while I corrected them and said “I’m mostly in Cambridge” but gave up. Tonight, after hanging out at the TechStars Boston Mentor evening and program kickoff, I got into a long discussion with a Bill Warner and Ken Zolot about Cambridge, Boston, and startup communities. At some point in the conversation I blurted out “I have no idea why we call this program TechStars Boston instead of TechStars Cambridge.” And then something that I thought was important dawned on me.

Over the last three weeks I’ve had numerous people ask me how my trip to Boston has been going. For a while I corrected them and said “I’m mostly in Cambridge” but gave up. Tonight, after hanging out at the TechStars Boston Mentor evening and program kickoff, I got into a long discussion with a Bill Warner and Ken Zolot about Cambridge, Boston, and startup communities. At some point in the conversation I blurted out “I have no idea why we call this program TechStars Boston instead of TechStars Cambridge.” And then something that I thought was important dawned on me.

My entire entrepreneurial view of “Boston” is centered around Cambridge. I’ve been here for two of the last three weeks (I spent four days in New York). I’m staying in a hotel in Kendall Square across from Google and next to MIT. I’ve spent my days walking to meetings at MIT, Kendall Square, Tech Square, Central Square, and East Cambridge including what I refer to as “the old Lotus building”. I’ve had all of my meals in Kendall Square or Central Square. Other than running, I’ve only been physically in Boston four times – first when I arrived at the airport, then when I took the train to New York, then when I returned on the train from New York, and finally when I spent the morning at Fidelity’s FCAT offices at Summer Street.

Now, I know there is plenty of startup activity in Boston. My old neighborhood near Fort Point Channel (I used to live on Sleeper Street in a condo at Dockside Place) is bustling with startup activity. There’s plenty of stuff on 128 and 495. There’s are other entrepreneurs tucked around the city. But that’s not the interesting story, at least in my mind.

The few square miles in Cambridge around MIT is the white hot center of startup activity in the region. One of my basic principles of startup communities is the need for what I call entrepreneurial population density (EPD) which I calculate as the total number of entrepreneurs and employees of entrepreneurial companies divided by the total number of all employees in a region. Then an even more powerful metric is entrepreneurial density, which is EPD / size of region. A large EPD in a small physical region wins.

Part of the magic of Boulder is the entrepreneurial density of the place. And as I wander from meeting to meeting in Cambridge, running into people on the street who I know, or who I met with the day before, or I who I want to know, reminds me of the dynamic in Boulder. For example, I ran into Matt Cutler on my way to Rich Levandov’s office and we walked over together. I bumped into the StartLabs organizers when going to a meeting with Will Crawford. I saw Joe Chung while hanging around StartLabs. I saw 50+ mentors who I knew last night at TechStars and expect to see more today when I’m there. While having breakfast with Michael Schrage at the Cambridge Marriott Joost Bonsen came over and said hello. At Dogpatch meeting with Yesware I saw Dave Greenstein and gave him a hug for his new kid. And the list of moments like this, which happened with 10 square blocks, go on and on. But when I hop on the red line and travel to South Station, the magic disperses.

I remember when the Boston VC community moved from downtown Boston to Waltham. I understood it was an effort to create a “Sand Hill Road” like venture community but the big miss was that an MIT student couldn’t hop on a bike and ride to Waltham like a Stanford student could with Sand Hill Road. And it’s no surprise that downtown Palo Alto, which is even closer to Stanford, is an attractive place for VCs to hang out. The snarky message when the VCs moved to Waltham was that they wanted to be close to their fancy houses and their private golf clubs and the entrepreneurs could come to them. It’s no surprise that many of these firms have relocated to Cambridge, recognizing that they should be in the middle of the entrepreneurial energy.

I’d suggest to the Cambridge and Boston startup communities that they should think of themselves as two separate but related communities. Even within Boston, it seems like there are different startup communities in downtown, 125, and even 495. I think that thinking of it “Boston” is a mistake.

In my world view, the entrepreneurs drive the startup community. Focus on entrepreneurial population density and entrepreneurial density – and make sure your geographic region is small. Over time, linking the critical mass together in a larger region (e.g. Silicon Valley or Boston) is fine, but the real power comes from the startup communities with the largest EPD in small physical regions which are big enough to have critical mass.

Six months ago I wrote a post about how I think about competition which included a list of topics that summarizes my philosophy. I covered the first item, Be The First Mover, but then went on to other things, like thinking about competitors every single day. I’m back today with the second topic, “Resegment If You Aren’t In The Top Three.”

Six months ago I wrote a post about how I think about competition which included a list of topics that summarizes my philosophy. I covered the first item, Be The First Mover, but then went on to other things, like thinking about competitors every single day. I’m back today with the second topic, “Resegment If You Aren’t In The Top Three.”

If you look at the Foundry Group portfolio, you’ll notice a lot of market leaders. Zynga is the obvious one, but I’ll assert that there are many others, including AdMeld (now part of Google), Cheezburger, Fitbit, Gnip, Makerbot, Oblong, SendGrid, Topspin, Trada, and Urban Airship. After that there is a category of companies who might be market leaders, but it’s too early to tell as they are still very young. And, if you look at some of the successful companies we have had from our previous investing at Mobius Venture Capital, you’d see market leaders like Postini, Return Path, FeedBurner, Rally, Stratify, NewsGator, and Sling Media.

An important nuance is that these companies weren’t unambiguously market leaders when they got started. While some of them created entirely new markets, others entered into existing markets. In some cases, there were only a few players as the markets were new. In other cases, they took the existing market and resegmented it.

Existing markets are wonderful places to go play in especially if they are expanding rapidly. Entrepreneurs are drawn to fast growing markets, which is awesome, but there are many who I see that are simply trying to play a fast follower game. I’ve been there, having invested in “company #17 in a market.” Unless you get lucky, that generally sucks.

I’ve developed a viewpoint that if you aren’t in the top three in your market segment, you should “resegment.” Step back and redefine the market segment you are going after. Change the customer, change a product focus, change the distribution channel, or change the partner dynamic. Sometimes it’s a tweak, other times it’s more radical. But change something so that you are in the top three of the “new market”.

Don’t bullshit yourself about this. I’ve been the investor in many companies who weren’t in the top three that were going to get there with the next release, or a new sales VP, or something exogenous that would happen to the existing market leaders, or a magic trick that no one had thought of yet. This is almost always a losing strategy. Don’t count on luck. Resegment.

After sleeping 13 hours on Friday night and then 14 hours last night it’s pretty clear that a week like last week isn’t sustainable for me. At brunch today, Amy guessed that I worked 80 hours between Monday and Friday, ran three days (after coming off a double long weekend where I did two 10 mile runs), travelled from Boston to NY and then NY to Boston late at night, and generally wore myself out.

I’m heading out for a 15 mile run in Boston and expect I’ll be garbage collecting all the random thoughts from the week. The backdrop in my world was dealing with SOPA/PIPA, which I’m glad is dead, for now. Based on all the rhetoric over the weekend, I have no doubt that it’ll be back soon as an issue and/or woven into some other bill that seems totally innocuous. Regardless, the experience around this over the last few months has impacted me pretty profoundly – both in my disdain for politics as usual, liars, and ass covering as well as my pride for grassroots leadership and the power of the Internet and the Web to get the word out and engage people.

I hope to spend zero minutes on this topic this upcoming week, although I put that in the fantasy category as I’m sure reality will interject itself. In the mean time, I encourage you to go take a look at a few more posts just to cement in your mind what is going on so you can be prepared for the next wave of it.

Joel Spolsky has two last things about SOPA/PIPA and then he will shut up. I hope he never does – he’s brilliant, articulate, and totally gets it. His two suggestions are to (1) use what we’ve learned to start lobbying for our own laws and (2) figure out a way to shift political ad dollars from TV to the web. It’s free to advertise on YouTube – let’s force it to be free to advertise on NBC, or at least so prohibitively expensive on a relative basis that it’s not worth it.

H.R. 1981 – Protecting Children From Internet Pornographers Act of 2011 – has embedded in it an amendment that’ll have your internet service provider tracking all of your financial dealings online. And yes, the sponsor of this is Lamar Smith, the same guy who sponsored SOPA. I wonder how many more bills there are out there like this – I certainly have no time or bandwidth to deal with them since I’m trying to help create the future.

Does Online Piracy Hurt The Economy? A Look At The Numbers. Here is some empirical evidence in Forbes that it doesn’t.

If Congress wants jobs, it can’t want SOPA. Talking point #1 for SOPA/PIPA morphed into “piracy costs jobs.” Over the course of last week, there were many people who were polite against being against piracy (for example, I am), but I don’t know of one who said “but piracy actually costs jobs and I can prove it.” I’ve concluded the piracy costs jobs thing is classic talking point rhetoric – if we hear it enough times then it must be true. Wouldn’t it be ironic if there was actually net job growth based on the dynamics of the current content economy?

If you were involved in opposing SOPA/PIPA recently, thank you for your efforts. These were horrible bills at some many levels and they needed to be shut down. The cynic in me knows that this is far from over but for now I’m going to go for a run and try not to think about it too much.

This post should be sung to the tune of The World Is A Vampire by the Smashing Pumpkins

“the world is a vampire, sent to drain

secret destroyers, hold you up to the flames

and what do i get, for my pain

betrayed desires, and a piece of the game

even though i know-i suppose i’ll show

all my cool and cold-like old job

despite all my rage i am still just a rat in a cage

despite all my rage i am still just a rat in a cage

then someone will say what is lost can never be saved

despite all my rage i am still just a rat in a cage”

Some VCs like rap, but I’m old school 80’s grunge, heavy metal, head banger music with some 90’s fruit bands mixed in. The chorus of The World Is A Vampire was echoing in my head as I took a shower this morning. And then the first line morphed into “My world is a network” and I started thinking about networks and hierarchies.

Earlier this week I was in New York. I spent Tuesday with my dad. I got up early, went for a run along the Hudson River, grabbed some Starbucks oatmeal, and did phone calls and email until 11. We then got together and wandered over to Union Square Ventures where we had lunch with the USV partners and talked about the healthcare industry and how technology could radically alter it as well as the relationship between each of the different constituencies. After lunch we got in an Uber and went over to MakerBot’s office (the Botcave) where I gave my dad a tour of the world of 3D printing. We took the subway back to Manhattan and walked to dinner with Fred Wilson, where we talked about healthcare some more.

Sometime during the day I had a few phone calls. One of my calls was with a Senator about PIPA. Another was with a CEO about a strategic partner. Another was with Eric Norlin about Blur. They were all short calls (as anyone I’ve ever talked to on the phone knows – I’d rather be off within five minutes than discuss football, the weather, and the kids I don’t have.) After the call with Eric, my dad asked “how do you keep track of all this stuff?” It was asked in a loving way with a glint of humor and amazement. I responded simply “I don’t – I just let it wash over me.”

If you follow USV’s investment thesis, you know that it’s different from Foundry Group’s thesis. While my partners and I are focused on a set of broad horizontal themes, USV is investing in the application layer of the Internet with a particular focus on Internet services that create large networks. Sometimes our paths cross (as in Zynga) and we co-invest together, but independent of that we are close friends and intellectual counterparts.

At the lunch with my dad, I participated in the conversation but spent most of it reflecting about the doctor / patient relationship and how critical it was for that the be the essence of the dynamic driving the healthcare system. Unfortunately, this relationship has been completely co-opted by all of the other constituents such as insurance companies, healthcare product vendors, hospitals, drug companies, and the government.

As I was working with a bunch of other amazing people over the course of the week to defeat SOPA and PIPA, including my partner Jason Mendelson and Phil Weiser (the Dean of CU Law School), I realized that the network was taking back control of the discussion about politics from the hierarchy.

This morning, I pondered that some more. I’m sure I’ll be writing about it a lot in the next few months, but it’s clear that my entire life has shifted from a hierarchy model to a network model. I’m sitting in a hotel room in Cambridge, connected to a network (the Internet), communicating with anyone who wants to hear from my (a network) via a publishing approach that is the ultimate democratizer (my blog) while getting ready to go to a board meeting for Yesware (a distributed company that has a broad network of users), followed by a bunch of meetings with random people who reached out to me via email and the web. And, throughout the day, I’ll continue to interact with the many companies and people I’m involved with, mostly via email, but in a completely distributed and untethered fashion.

My world is a network. And being part of a hierarchy sounds to me like that poor rat in a cage.